CAC is a measure of how much it costs to acquire a new customer. To calculate CAC, divide the total cost of acquiring new customers (marketing expenses, sales expenses, etc.) by the number of new customers acquired.

For example, if Company XYZ spends $100,000 on marketing and sales efforts to acquire 100 new customers, then its CAC is $1,000.

CAC is an important metric for companies to track because it helps them understand how much they need to spend in order to acquire new customers. Additionally, CAC can be used to compare the efficiency of different marketing and sales channels in terms of customer acquisition.

What is CAC used for?

CAC, or customer acquisition costs, are the costs associated with acquiring new customers. This can include marketing and advertising expenses, as well as the costs of any sales or customer service staff needed to close new business deals. For many companies, CAC is one of the most important factors in determining overall profitability.

Acquiring new customers can be a costly endeavor, and CAC represents the amount of money that a company must spend in order to successfully bring a new customer on board. In order to keep CAC low, businesses need to focus on efficient marketing and sales strategies. Additionally, providing quality customer service is essential for retaining customers and ensuring they remain satisfied with your product or service.

While CAC is a critical metric for any business, it's important to keep in mind that it doesn't tell the whole story. For example, a company with a high CAC may still be profitable if its customers are particularly valuable and tend to stick around for a long time. Similarly, a company with a low CAC may not be as successful if its customers are less loyal and more likely to churn.

Ultimately, CAC is just one piece of the puzzle when it comes to evaluating a company's profitability. However, it can be a helpful metric for assessing whether or not a business is spending too much money on acquiring new customers. Additionally, by tracking CAC over time, businesses can get a better sense of whether their marketing and sales strategies are effective.

Benefits of low customer acquisition cost (CAC)

There are many benefits to having a low customer acquisition cost (CAC) including:

Growth:

A low CAC allows for more aggressive customer acquisition and growth.

Profitability:

A low CAC is essential for profitability as it means that a company can make money even if its customer lifetime value (LTV) is low.

Scale:

A low CAC allows a company to scale its customer base quickly and efficiently.

Market share:

In many markets, the company with the lowest CAC will win.

Customer loyalty:

A low CAC often leads to higher customer loyalty as it is easier to keep customers who have already been acquired than to constantly acquire new ones.

Important factors to consider when calculating CAC

There are a few important factors to consider when calculating your customer acquisition cost:

1. The cost of your marketing and advertising efforts:

This includes both online and offline marketing costs, such as site development costs, pay-per-click (PPC) advertising, print advertising, etc. Marketing spend is the core CAC's mission for any company.

2. The cost of sales and support:

This includes the cost of your sales team, as well as any customer service or support costs.

3. The lifetime value of a customer (LTV):

This is an important metric to consider because it helps you determine whether your CAC is worth the investment.

Your LTV should be greater than your CAC in order for your business to be profitable.

How Can You Calculate Customer Acquisition Cost (CAC)?

There are a few different ways that you can calculate your customer acquisition cost, but the most common method is to take your total marketing and sales expenses for a period of time divided by the number of new customers acquired during that same time period. This will give you your CAC for that specific time period.

However, it's important to note that your CAC can change over time. For example, if you launch a new marketing campaign and see an increase in new customers, your CAC will decrease. Similarly, if you experience a decline in new customers, your CAC will increase.

It's also important to keep track of your customer lifetime value (LTV) when calculating your CAC. This is because your LTV will give you an idea of how much revenue you can expect to generate from each customer over the course of their relationship with your business.

If your CAC is higher than your LTV, then you're likely losing money on each new customer that you acquire. On the other hand, if your LTV is higher than your CAC, then you're making a profit on each new customer.

How to reduce CAC?

If you're looking to reduce your CAC, there are a few things you can do:

Increase your marketing efforts:

This could involve increasing your advertising budget, expanding your reach through PR or social media, or improving your website's conversion rate.

Improve your sales process:

This could involve training your sales team, providing them with better leads, or streamlining your sales process.

Increase the value of your product:

This could involve adding new features or resources, improving customer support, or increasing the price of your product.

Customer acquisition cost is an important metric for companies to track and optimize. By reducing your CAC, you can improve your profitability and scale your business more effectively in any community.

Industry Benchmarks for Customer Acquisition Costs

There are a few industry benchmarks for customer acquisition costs. The most common is the cost per lead (CPL). This measures the cost of acquiring a new customer through marketing and advertising efforts. The average CPL across industries is $200-$300.

However, there are a wide range of CPLs depending on the industry , product, and service. For example, companies that sell high-end products or services will have a higher CPL than those that sell low-end products or services. Additionally, companies that have a longer sales cycle will also have a higher CPL.

There are a few other industry benchmarks for customer acquisition costs, but the CPL is the most common and important one to know. By understanding your industry's average CPL, you can better gauge your own marketing and advertising efforts. Additionally, you can use this benchmark to compare your customer acquisition costs to other companies in your industry.

Frequently Asked Questions

How do I acquire new customers?

There are a number of ways to acquire new customers. The most common and effective methods include online advertising, search engine optimization (SEO), content marketing, social media marketing, and referral marketing.

What is the best way to acquire new customers?

There is no one-size-fits-all answer to this question. The best way to acquire new customers depends on your business, your budget, and your target market.

However, some of the most effective methods for acquiring new customers include online advertising, SEO, content marketing, social media marketing, and referral marketing.

What are the most common mistakes businesses make when trying to acquire new customers?

Some of the most common mistakes businesses make when trying to acquire new customers include failing to properly research their target market, failing to create a compelling offer, and failing to effectively promote their offer.

What are some tips for acquiring new customers?

Some tips for acquiring new customers include researching your target market, creating a compelling offer, and promoting your offer effectively.

Additionally, it is important to track your results so that you can continuously optimize your efforts.

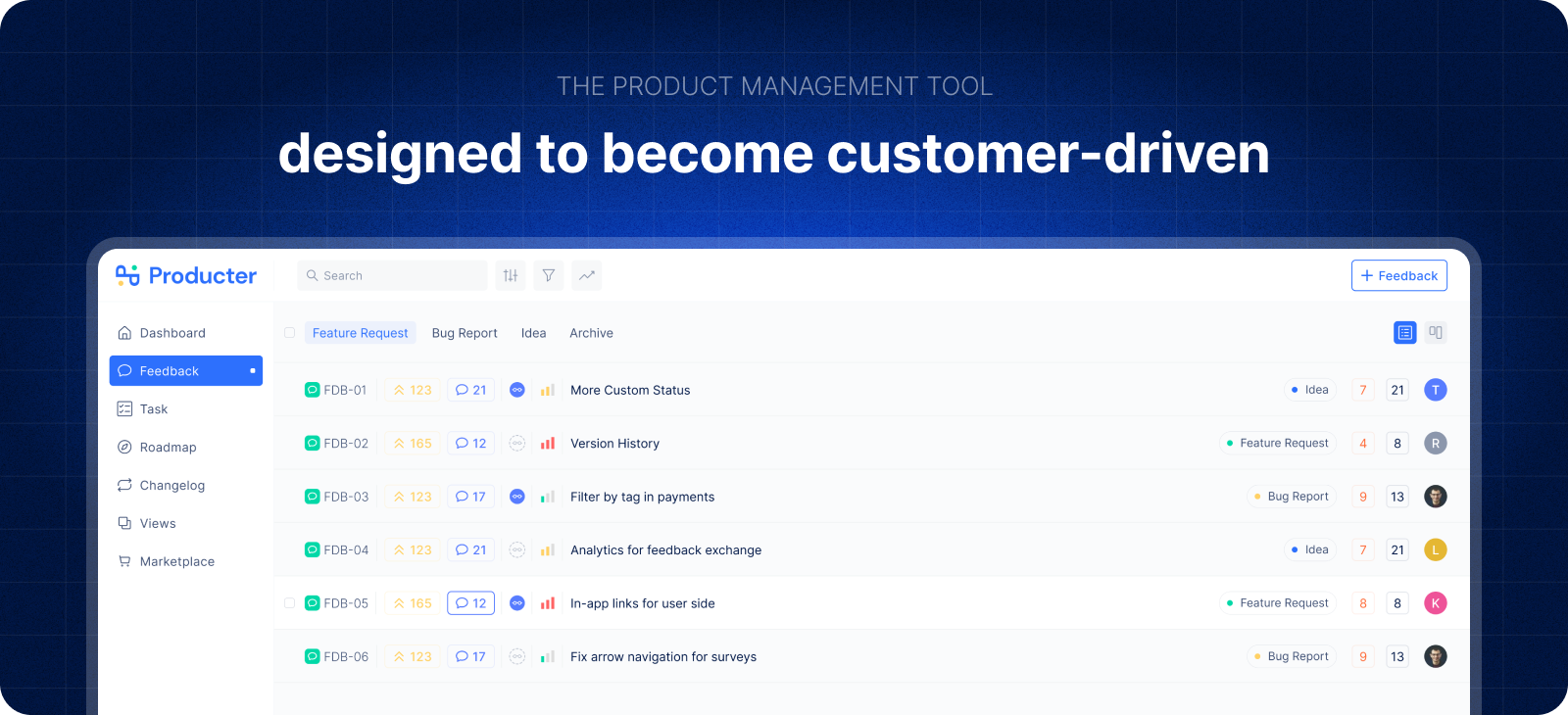

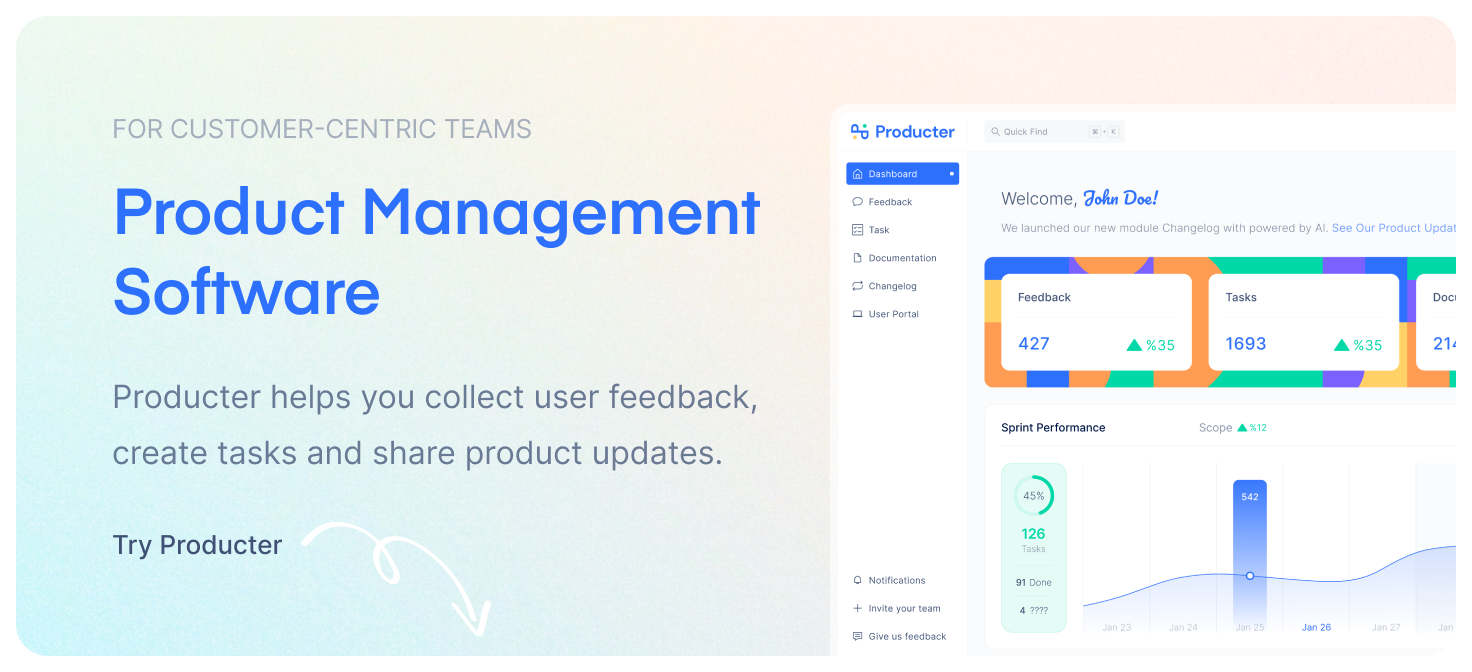

Producter is a product management tool designed to become customer-driven.

It helps you collect feedback, manage tasks, sharing product updates, creating product docs, and tracking roadmap.